Bloomberg) -- Investors appear to be losing patience with Ark Investment Management’s genomics fund.

The Ark Genomic Revolution ETF (ticker ARKG) has seen roughly $520 million of outflows in November amid sinking returns. The fund is down 27% year-to-date as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, the ETF is faring far worse than the broader biotech sector, with the Nasdaq Biotechnology Index up 10.49% this year.

ARKG is currently trading at $66.38 a share, lower than its level a year ago, before a steep rally that crested early in 2021. The genomics fund has also seen the largest outflows among Ark’s ETFs this year.

“It’s interesting that typically loyal Ark investors have been bailing on the ETF,” said Nate Geraci, president of The ETF Store, an advisory firm. “The fund’s assets have been chopped in half since February. While I don’t believe the ETF is experiencing some of sort of ‘doom loop,’ clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.”

The ETF’s two top holdings, Teladoc Health Inc. and Exact Sciences Corp., have weighed on its performance, with drops of some 45% and 37% this year, respectively.

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash, said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.

“This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research,” said Jablonski.

https://www.bnnbloomberg.ca/cathie-wood-s-genomics-fund-is-down-27-and-outflows-are-growing-1.1685602

Citadel is experiencing the worst PR week of its existence.

Its CEO has been trending relentlessly for lying to the House Financial Committee.

In response they have issued highly caveated tweets to reject the allegations, which combined with the Streisland effect, makes them look even less trustworthy than saying nothing.

If you were a rival Hedge Fund, would you let poor Kenny lick his wounds? NO. You would absolutely exploit this moment of weakness by trying to poach as many of Citadel’s high net worth clients as possible. You probably have a database of their contact details. You probably have account managers on the phone right now setting up dinners, meetings, cocktails, whatever to get them in a room and to convince them to withdraw all funds from Citadel and to invest instead in another HF not face down in the shit.

What happens when a millionaire/billionaire client starts to get nervous? Starts to express sentiments of pulling out funds? Along with the obvious panic it creates across the client base, it will require immediate senior staff engagement to mitigate. This can’t be handed over to some intern. They will demand to speak to the seniors, heck some will want to talk to Ken himself! I bet a significant amount of senior director level resource is currently focussed on trying to calm their clients the fuck down - to no avail. Every hour of their time is expensive. What to us is a meme, to them requires pissing significant resource away to control the fire. Ken Griffin trending for lying not only costs them money but also the precious time needed to focus on their other problems like apes DRSing shares non-stop.

tl;dr: The memes have real power. Ken Griffin is now fighting a war on multiple fronts, including trying to convince his clients to stay in the face of unrelentingly bad PR. The capital outflow is probably making them vomit right now. And like rats from a sinking ship we should expect more senior level departures.

No dates, but I’m feeling good, feeling great!

SHORT ANSWER: RTs keep contracting their purchase of meme shares on MARGIN instead of buying them outright with CASH.

COMPREHENSIVE ANSWER:

- When a RT commits to a Margin purchase of shares, the RT DOES NOT OWN THEM. The shares are Borrowed from the brokerage who Owns and holds them under the broker’s ‘Street Name’. The broker then Rehypothecates (re-lends the Brokerage’s shares) to a third party. Take a Wild Guess who the interested Third Parties are. It rhymes with ‘Bear Hedge Fund Managers’ who cram your margined shares right up your tail pipe via a 1 for 1 Short Position per share to drive the price down.

How do you think brokers have been able to do ‘commission free / no fee trades’? They are still making their money; but now, they charge the RT interest for the margin trade, then turn around and rehypothecate the same share and earn short interest on it too. One Share traded, two parties paying interest on it. How’s That for Slick??

Ever wanted to know why the bears have an Unlimited supply of ammo while Fintel says 100% of the free float is shorted??? Have any RT’s ever been curious how the Ortex short interest sometimes goes OVER 100%???? (e.g. 115%). Basically, RTs are screwing themselves by handing the HFMs a fresh condom and a tube of KY to do what they want to us with each share under the RTs margined under contract.

- INSTEAD: ‘BUY’ your Fav meme stonk on a CASH Only basis from your available ‘on-hand’ balance. This way your shares are Owned by You and ‘DIRECT REGISTERED’ in the Your name,,,, meaning the shares Can Not be Rehypothecated (re-lent) back out to your friendly neighborhood Bear HFM who promptly drops them into a darkpool for some good old fashioned block trading activities. I used to believe that short ladder attacks were killing us. Come to find out, it is us RTs killing us and the Bear HFMs are more than willing and able to drive the killing blow deeper.

Don’t take my word for it, Go back and read all xx pages of the Rehypothecation Agreement you signed when you opened your margin account. It’s there, that part I WILL guarantee. Fun Fact… The Rehypth Agreement is a boat load of pages written in 4pt font containing legalese for a reason. Brokers know that RTs see, “Blah,blah, blah, legal, legal, legal, I GET MORE SHARES AS SOON AS I CLICK THE STUPID ACCEPT BUTTON, and 400,000 shares is WAY better than 4,000 shares. YIPPIE!!!” That is, until we come to the realization that the 🚀🚀🚀🚀🚀 shares we just YOLO’d o

... keep reading on reddit ➡Where can I get info on stock market inflows & outflows? I am looking for data to see what the whales are doing. Are major players buying or selling? Is there a different term I should use? I have tried to find it myself with no luck.

I am not on Plaid, but the MX import partner.

Twice now, inflows to my checking account, have come through as duplicate, cleared transactions, but as outflows.

Ex #1: January 10th, my girlfriend Zelle’s me $28.68 for half of groceries. It appears immediately in my checking so I add it as an inflow and clear it.

However, yesterday, I get the notification I have imported transactions, and there is a cleared transaction for -$28.68, with a randomly assigned name. I was really confused but just deleted it because I couldn’t reconcile it, and chalked it up to me duplicating something in manual entry.

Ex #2: Yesterday, I deposited a $10.11 check (inflow) from a class action lawsuit. It cleared instantly so I input it manually, cleared it, and reconciled my account. Then, today I go in, an auto import has added a cleared -$10.11 transaction.

—

It is completely bizarre. I already contacted support. Again, I was able to delete it, and thankfully I reconcile every day, so it really stood out to me.

I can imagine this being an absolute nightmare for others who reconcile less frequently, so I wanted to share.

I’m not trying to create FUD, I still hold a substantial ARK position. I read about the concerns regarding outflows and size of the fund putting pressure on the illiquid holding back in February and now the concerns have been resurfacing. Is there any actual control or counter to this risk?

The only actual counter I see to this is to sell the liquid holdings which further rebalances the fund allocation towards larger concentrations in the illiquid ones. How many liquid large cap stocks are left, aside from TSLA? I’m getting increasingly concerned, but have yet to see a valid reason why I shouldn’t be concerned. Can someone help me understand this??

Using Active Trader Pro.

I've seen that RobinHood has the option to show you the inflow/outflow of orders. Does ATP have the same? I haven't found it yet if so.

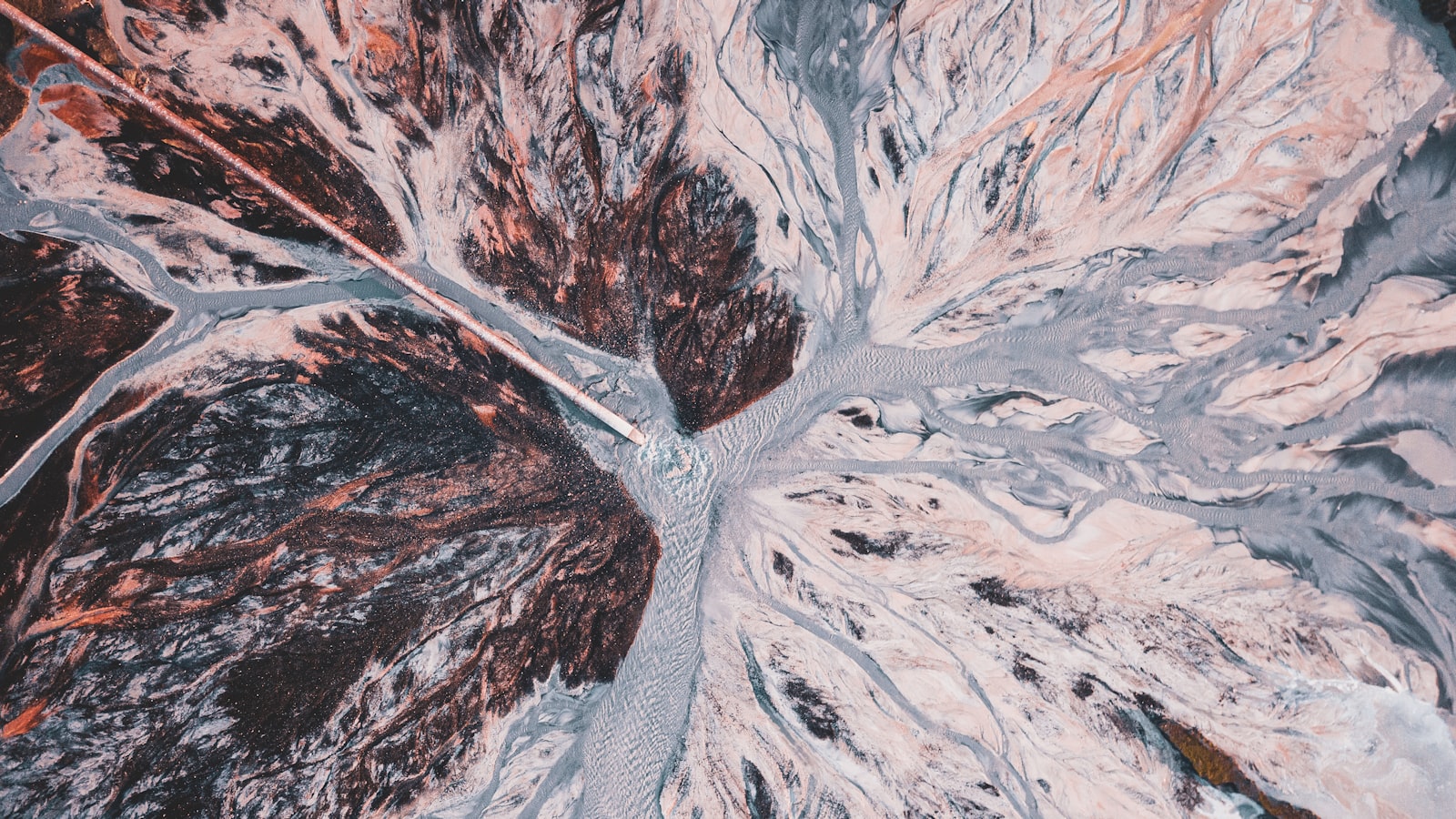

Hey - I'm a distilling noob that is trying to run a chinese pot still (image attached) and I can't get the water to leave the condenser pot. So the cold (warming) water overflows the condenser pot. Not sure exactly what I'm doing wrong. I feel like there should be an outflow pump cause that water just stays where it is. Any ideas?