Edit1: As u/BohemianConch pointed out, the test was supposed to be conducted back in 2020, but it was pushed to 2021 due to corona, which explains the weird intervals.

Edit2: Looking at the 2018 stress test, the stress exerted on the system seems to have increased 30-50% across the different test parameters from the last test.

So, I work in a large european bank. Today I saw a very interesting article on our internal site (I cannot provide a link for obvious reasons).

This article explained the EBA stress test that went down a few days ago.

The stress test tested to see how the banks would handle a 30% drop in the housing market, negative GDP growth and increasing unemployment and a pretty modest inflation (If you ask me 2.4% over 3 years sounds low compared to the 6.12% the americans aim for over 3 years.) https://www.eba.europa.eu/sites/default/documents/files/document_library/Risk%20Analysis%20and%20Data/EU-wide%20Stress%20Testing/2021/1017758/EBA-2021.3792-2021-EU-wide-stress-test-infographics-reports.png

As far as I can see, the previous tests has been conducted with 2 year intervals, on even years.

This begs the question, why are we testing now? See Edit1.

I havn't looked at the results of the tests, Il leave up to the fractal wrinkle brains.

All information on the test can be found here. https://www.eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing

https://www.eiopa.europa.eu/content/esas-highlight-risks-phasing-out-of-crisis-measures-and-call-financial-institutions-adapt

The blame game officially kicked off this week, starting with the comments from the BoE's governor and now, this.

I'm not surprised that they blame retail but the fact that this whole situation made it to their report, not to mention throwing the US under the bus, indicates that we are truly in the endgame.

TLDR:Buy and hodl.

This is not financial advice. Do not listen to me. Make your own decisions.

Edit 1: Added link to the report and updated spacing.

https://preview.redd.it/bedpt3rwai921.png?width=750&format=png&auto=webp&s=1a7365ec1c4f92c0998d52de4f910e4028be93c2

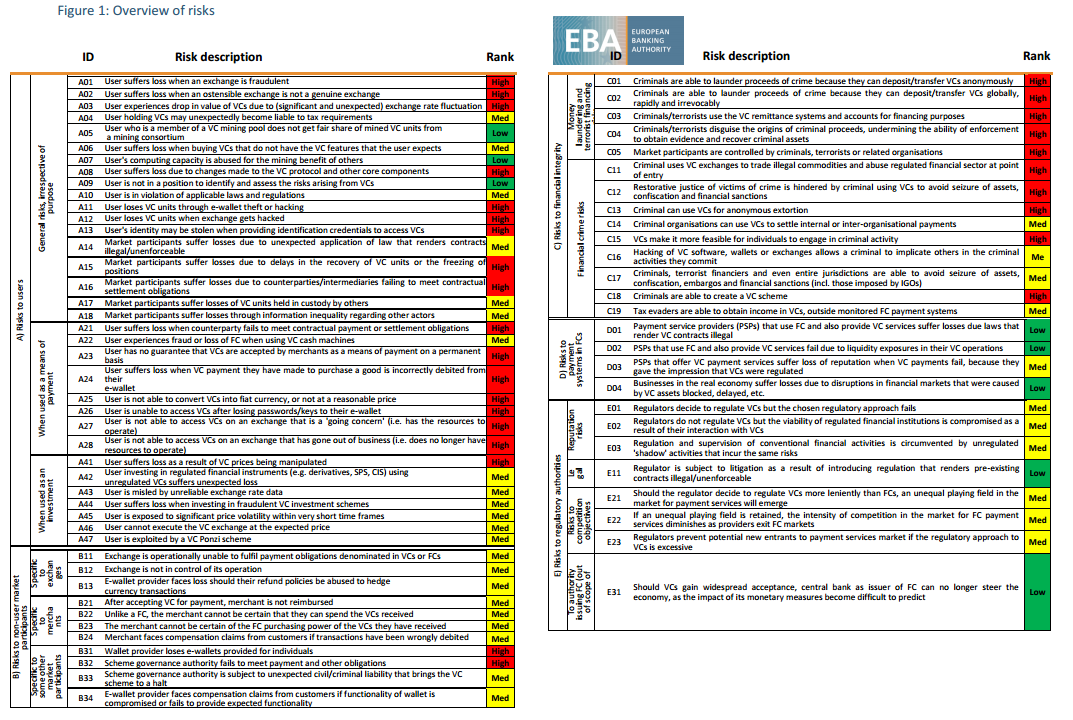

"When a group of miners controls more than half the total computational power used to create VC [virtual currency] units, the group is potentially in a position to interfere with transactions, for example by rejecting transactions validated by other miners."

Bottom of page 15 http://www.eba.europa.eu/documents/10180/657547/EBA-Op-2014-08+Opinion+on+Virtual+Currencies.pdf EBA press release at http://www.eba.europa.eu/-/eba-proposes-potential-regulatory-regime-for-virtual-currencies-but-also-advises-that-financial-institutions-should-not-buy-hold-or-sell-them-whilst-n , as reported already by Reuters and Bloomberg